Case Interview Frameworks: When to Use Them (2026)

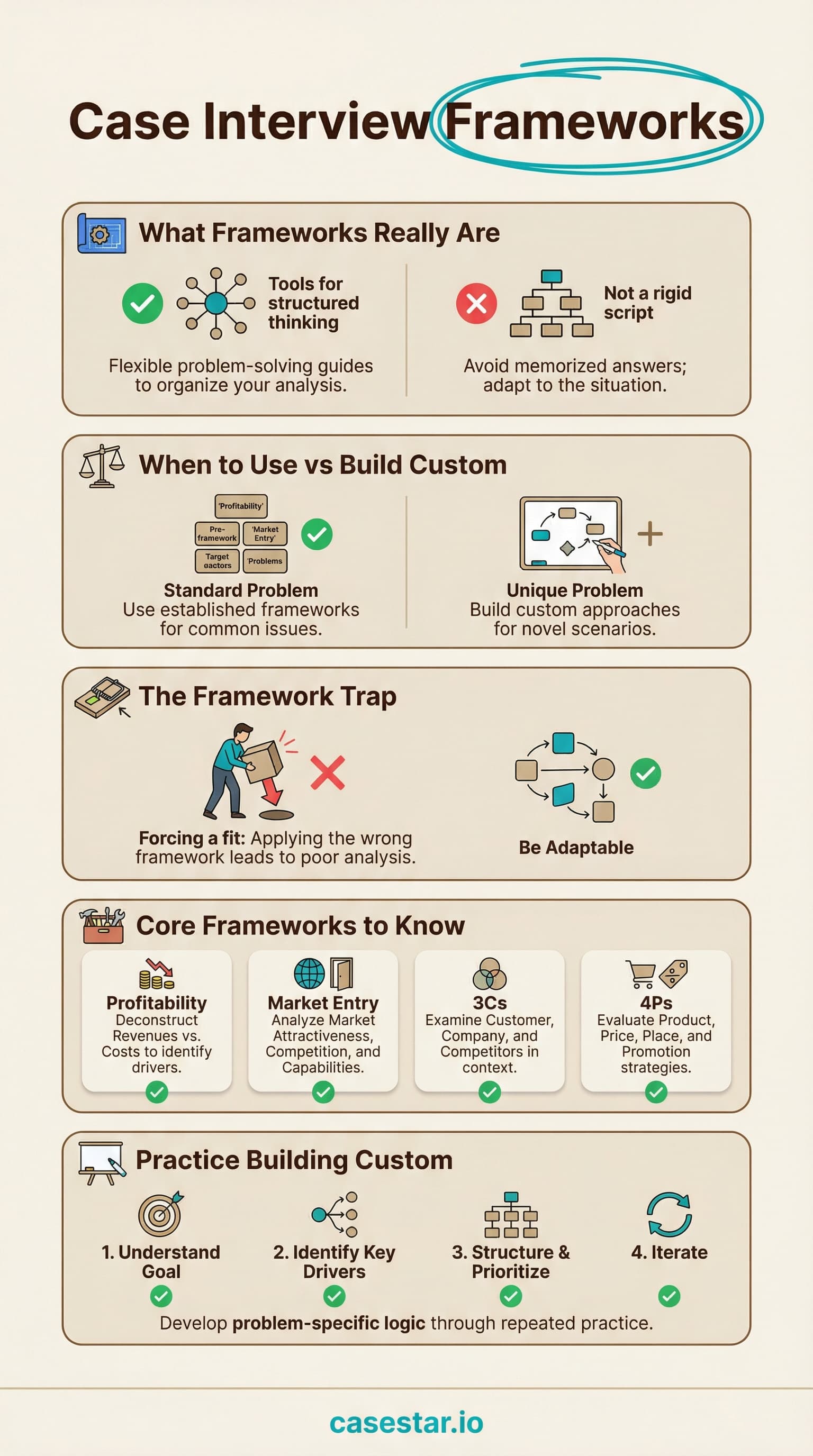

Executive Summary: Frameworks exist to organize your thinking, not to be memorized and applied mechanically. The candidates who get offers build custom structures for each case. Learn the underlying logic of common frameworks, then use them as building blocks rather than templates.

Contents

Why do case interview frameworks exist?

Business problems are messy. A CEO asks "Should we enter the Chinese market?" and suddenly you are facing questions about market size, competitive dynamics, regulatory requirements, supply chain logistics, consumer behavior, and a dozen other factors. Without some way to organize this, you drown in complexity.

Frameworks give you a starting structure. They represent patterns that consultants have found useful across hundreds of similar problems. The profitability framework exists because breaking down profit into revenue and costs has helped solve countless "Why are we losing money?" questions.

The key word is "starting." A framework is not an answer. It is a way to break a large question into smaller, answerable pieces. The actual analysis happens within those pieces, and the specific pieces you need depend on the specific problem.

What frameworks actually do

- Provide a logical starting point when facing a new problem

- Ensure you consider important factors systematically

- Help you communicate your approach clearly to interviewers

- Give you building blocks to customize for specific situations

Interviewers want to see that you can organize ambiguous information and work through it logically. Frameworks help you do that. But they help you do it by providing mental models, not by giving you a template to fill in.

What is the 'Framework Trap'?

Here is what goes wrong for many candidates: they memorize five or six frameworks, then try to match each case to one of them. The interviewer says "Our client is a regional grocery chain seeing declining profits" and the candidate immediately thinks "profitability framework" and starts reciting revenue minus costs, price times quantity.

Interviewers see this constantly. They know what a memorized framework looks like. The giveaways are obvious: the structure does not quite fit the case, the candidate forces the conversation into their predetermined buckets, and they struggle when the interviewer asks questions outside their template.

Signs you are stuck in the framework trap

- Your structure sounds identical across different cases

- You include buckets that are not relevant to the specific question

- You freeze when the case does not match a familiar pattern

- You spend more time thinking about which framework to use than about the actual problem

- Your analysis feels like filling in boxes rather than solving a problem

The irony is that memorizing frameworks is supposed to save time, but it often does the opposite. Candidates who try to force-fit templates end up going down unproductive paths and missing what actually matters in the case.

The goal is understanding, not memorization. When you understand why profitability cases examine revenue and costs, you can adapt that logic to any profit-related question. When you just memorize "Profit = Revenue - Cost, Revenue = Price x Quantity," you are stuck if the case needs something different.

What are the 5 key case interview frameworks?

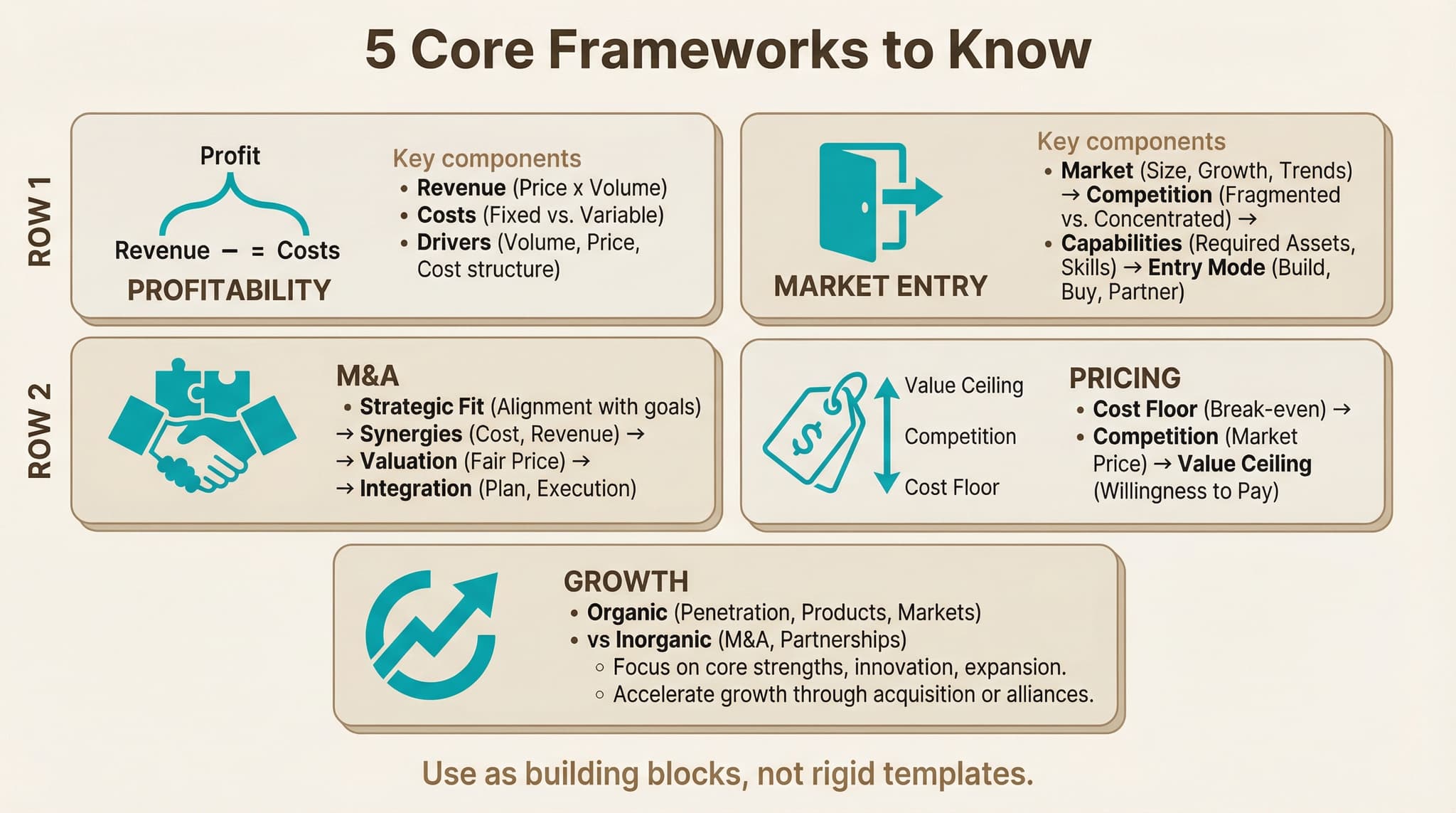

These are the core frameworks you should understand. For each one, the goal is to grasp the underlying logic so you can adapt it, not to memorize a rigid structure.

1. How do I use the Profitability Framework?

The logic: Profit equals revenue minus costs. If profit is declining, either revenue dropped, costs rose, or both. Breaking this down helps you locate where the problem actually sits.

Revenue side: Price changes, volume changes, mix shifts (selling more low-margin products), new vs. existing customers, different channels.

Cost side: Fixed costs (rent, salaries, equipment) vs. variable costs (materials, commissions). Look at where costs increased and whether that was expected (growth-related) or problematic (inefficiency).

When to adapt it: Not every profitability case needs all branches. If the interviewer tells you revenue is flat, skip the revenue drill-down. If they mention a specific cost increase, focus there. Let the case guide where you spend time.

Learn more: Profitability analysis lesson

2. How do I use the Market Entry Framework?

The logic: Before entering a new market, you need to assess whether the market is attractive, whether you can compete, and how you would enter.

Market attractiveness: Size, growth rate, profitability, trends. A large growing market is more interesting than a small shrinking one.

Competitive landscape: Who are the existing players? How concentrated is the market? What are the barriers to entry? Can you differentiate?

Company fit: Do you have relevant capabilities? Does this align with strategy? What would you need to build or acquire?

Entry options: Build organically, acquire an existing player, or partner with someone who has local expertise. Each has different cost, speed, and risk profiles.

3. How do I use the M&A Framework?

The logic: An acquisition only makes sense if the combined company is worth more than the two separate companies, and you can buy the target at a price that captures some of that value.

Strategic rationale: Why this target? Revenue synergies (cross-selling, new markets), cost synergies (consolidation, economies of scale), capability acquisition, or competitive reasons (buying a threat).

Target assessment: Financial health, management quality, cultural fit, hidden liabilities. Due diligence uncovers what the numbers do not show.

Synergy quantification: What specific synergies exist? How much are they worth? How long to realize them? Be skeptical. Most acquirers overestimate synergies.

Integration: How will you combine the companies? Integration is where most deals fail. Consider operations, systems, people, and culture.

4. How do I use the Pricing Framework?

The logic: Optimal pricing depends on three factors: what it costs you (floor), what competitors charge (benchmark), and what customers are willing to pay (ceiling).

Cost-based: Calculate your costs and add a margin. Simple but ignores what the market will bear. Works for commodities.

Competition-based: Price relative to competitors. Requires understanding your differentiation. Are you premium, value-oriented, or matching the market?

Value-based: Price based on the value you deliver to customers. Requires understanding customer willingness to pay and the alternatives they have.

Pricing strategy: Beyond the number, consider structure (subscription vs. one-time, bundling, tiering), psychology (anchoring, decoy pricing), and implementation (how to communicate changes).

5. How do I use the Growth Strategy Framework?

The logic: Companies can grow by selling more of what they have, expanding what they offer, or reaching new customers. The Ansoff matrix captures this: market penetration, product development, market expansion, diversification.

Organic options: Increase market share, raise prices, improve retention, expand geographically, launch new products, enter adjacent segments.

Inorganic options: Acquire competitors, buy into new markets, form partnerships or joint ventures.

Prioritization: Not all growth is equal. Consider potential size, probability of success, time to impact, investment required, strategic fit. The best answer usually involves trade-offs between short-term and long-term, risk and return.

When should I use each framework?

The table below maps common case questions to the frameworks most likely to be relevant. But remember: these are starting points to adapt, not templates to apply directly.

| Framework | Use when the question involves | Key questions to answer |

|---|---|---|

| Profitability | Declining profits, margin pressure, cost concerns, revenue drops | Is the problem on revenue or cost side? What changed and when? |

| Market Entry | New geographies, new segments, new product categories, expansion decisions | Is the market attractive? Can we win? How should we enter? |

| M&A | Acquisition targets, merger decisions, due diligence, integration planning | Why this target? What synergies exist? What should we pay? |

| Pricing | New product pricing, price increases, competitive pricing pressure, bundling | What is cost floor? What do competitors charge? What will customers pay? |

| Growth | Revenue growth targets, strategy development, expansion planning, diversification | What are the options? How do they compare on impact, feasibility, and fit? |

Important: Many cases blend multiple frameworks. A "declining profitability" case might reveal that the root cause is competitive pricing pressure (pricing framework) or that the solution involves entering a new segment (market entry). Stay flexible and follow where the analysis leads.

How do I build custom case structures?

The candidates who get offers do not apply pre-made frameworks. They build structures tailored to each case. This is harder than memorizing templates, but it produces better analysis and impresses interviewers.

The process

1. Start with the question

What exactly is the client trying to decide? "Should we acquire Company X" is different from "How do we integrate Company X after acquisition." Make sure you understand the specific question before structuring.

2. Ask what you need to know

Before reaching for a framework, ask yourself: "What would I need to know to answer this question?" Make a mental list of the key unknowns. This grounds your structure in the actual problem rather than in a generic template.

3. Group into logical categories

Organize your list into 3-4 buckets that are mutually exclusive (no overlap) and collectively exhaustive (nothing important is missing). This is the MECE principle. Your buckets should flow logically and cover the full scope of what matters.

4. Pull from framework building blocks

Now frameworks become useful - as components, not templates. If the case involves profitability, the revenue/cost breakdown might form one of your buckets. If market entry is relevant, the market/competition/capabilities logic might inform another. Mix and match based on what this case needs.

5. Customize labels and sub-points

Use language specific to the case. If the client is a hospital, say "patient volume" instead of "quantity." If they are a SaaS company, say "customer acquisition cost" and "churn rate." This shows you are thinking about their specific situation.

Example: Custom structure for a case

Case prompt: "Our client is a regional pizza chain with 50 locations. Same-store sales have declined 15% over two years. What should they do?"

Generic framework approach: Revenue = Price x Quantity. Costs = Fixed + Variable. (Then struggle to make this fit a restaurant context.)

Custom structure approach:

- Customer traffic: Are fewer people coming in? Dine-in vs. delivery trends, competition from new entrants, location-level variations

- Order value: Are customers spending less per visit? Menu pricing, product mix, upselling effectiveness

- Competitive position: What is happening in the local market? New delivery apps, competitor actions, changing preferences

- Operations: Are there execution issues? Service quality, food consistency, store condition

The custom structure is still grounded in profitability logic (traffic and order value drive revenue), but it uses language specific to restaurants and includes factors particularly relevant to a regional food chain facing declining sales.

Practice building structures with our structuring drills.

How to practice

Building custom structures is a skill that improves with deliberate practice. Here is how to develop it.

Daily structuring drills (10 minutes)

Take a random business problem and build a structure in 2 minutes. Do not use any pre-made framework. Just ask: "What would I need to know?" and organize your answer. Do this with 3-5 problems daily. You can find prompts in news articles, business podcasts, or CaseStar's drill library.

Framework deconstruction

For each standard framework, ask yourself: "Why does this structure make sense?" Understand the logic, not just the components. When you grasp why profitability analysis separates revenue and costs, you can apply that logic to any profit question in any industry.

Case practice with structure focus

When practicing full cases, spend extra time on the structuring phase. After presenting your structure, reflect: Did it fit the case? What did you include that was not useful? What did you miss? Adjust your approach for the next case.

Get feedback on structures specifically

Ask practice partners or coaches to evaluate your structure before you proceed with analysis. Questions to ask: "Is this MECE? Does it fit the case? Would you prioritize differently?" This focused feedback improves structuring faster than just doing more cases.

Study good structures

When you see a case solution with a strong structure, analyze what makes it work. How did they customize for the specific situation? What framework elements did they adapt? How did they prioritize? Learning from examples accelerates your own development.

What is the ideal progression for learning frameworks?

Early in prep: You might lean heavily on standard frameworks as training wheels. That is fine. As you practice, gradually wean yourself off. By interview time, you should be building custom structures automatically, using frameworks only as unconscious mental models that inform your thinking.

Frameworks FAQ

Should I memorize case frameworks?

No. Memorizing frameworks often backfires because generic templates rarely fit real cases. Learn the underlying logic and use frameworks as building blocks for custom structures.

What should I do if the case does not fit a framework?

Most cases do not fit neatly into one framework. That is the point. Build a custom structure based on what the specific question requires. Use framework components as building blocks, not as templates.

How many frameworks should I know?

Understand 5-6 core frameworks: Profitability, Market Entry, M&A, Pricing, Growth, and Operations. But the goal is understanding the logic, not memorizing components.

What frameworks do MBB firms expect?

None of these firms expect specific frameworks. They want to see structured thinking that fits the problem. Using a memorized template can hurt you because it signals formula application rather than critical thinking.

How should I present my case structure?

Clearly state 3-4 areas you want to explore, explain briefly why each matters for this case, and indicate which you would prioritize. Use the specific language of the case, not generic framework terminology.

How long should the structuring phase take?

Take 60-90 seconds after the prompt to organize your thoughts. It is fine to take a moment to think. Rushing into a poorly organized structure is worse than pausing to build a good one.

Practice structuring with real-time feedback

CaseStar provides instant feedback on your structures and helps you build the custom-structuring skill that gets offers.

Try it freeSave this guide

Last updated: January 2026