MECE Framework: What It Means and How to Apply It

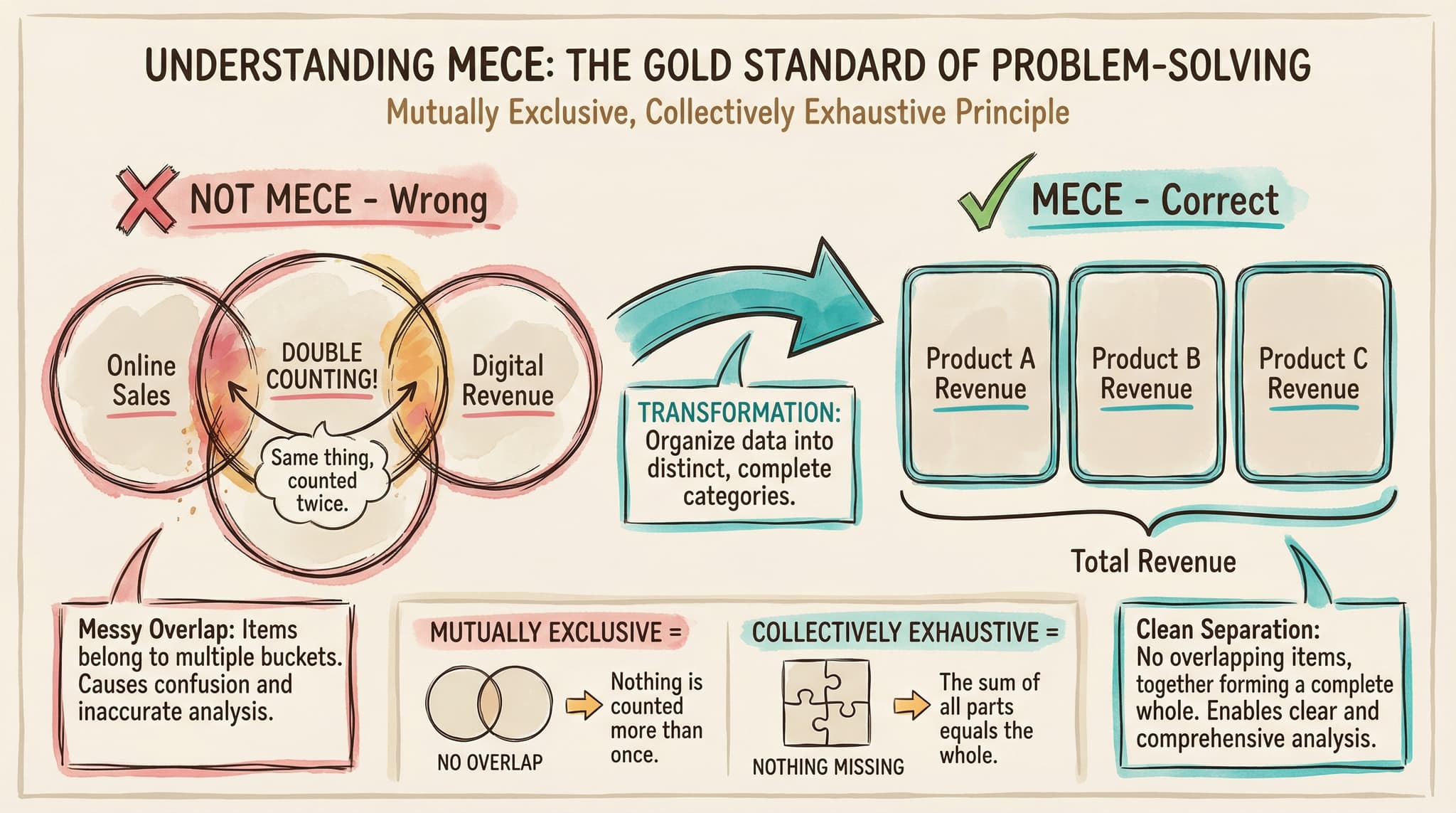

Summary: MECE (Mutually Exclusive, Collectively Exhaustive) is a structuring principle consultants use to break down problems. Categories should not overlap (mutually exclusive) and should cover everything (collectively exhaustive). This prevents double-counting and blind spots in your analysis.

Contents

What MECE stands for

MECE stands for Mutually Exclusive, Collectively Exhaustive. It is a way of organizing information so that categories do not overlap and nothing gets left out.

The term was popularized by McKinsey consultant Barbara Minto in her book "The Pyramid Principle." It has since become standard vocabulary in consulting and structured problem-solving.

Mutually Exclusive: Each item belongs to one category only. No overlaps.

Collectively Exhaustive: The categories together cover all possibilities. No gaps.

Think of it like sorting a deck of cards. If you sort by suit (hearts, diamonds, clubs, spades), that is MECE: each card belongs to exactly one suit, and every card has a suit. If you sorted by "red cards" and "face cards," you would have overlaps (the Queen of Hearts is both) and gaps (black number cards fit neither category).

Why consultants use MECE

Consultants deal with complex, ambiguous problems. MECE is their primary tool for creating clarity. When you structure a problem in a MECE way, you avoid two failure modes:

Double-counting

Without mutually exclusive categories, you might analyze the same issue twice under different labels. This wastes time and can lead to flawed conclusions. If you count the same revenue twice, your financial analysis will be wrong.

Blind spots

Without collectively exhaustive categories, you might miss something important. In case interviews, interviewers specifically test whether you have considered all relevant areas. A gap in your structure is a red flag.

MECE structures also communicate well. When you present a MECE breakdown to a client or interviewer, they can immediately see that you have covered everything and that your logic is clean. This builds credibility.

Mutually Exclusive explained

"Mutually exclusive" means no overlaps between categories. Every item should fit into exactly one bucket. If something could go in two places, your categories are not mutually exclusive.

Good example: Revenue by geography

Breaking down revenue by North America, Europe, Asia-Pacific, and Rest of World is mutually exclusive. A sale happens in one region. It cannot be in both North America and Europe.

Bad example: Customer segments

Segmenting customers by "price-sensitive," "brand-loyal," and "convenience-focused" is not mutually exclusive. A customer can be both price-sensitive and convenience-focused. When you try to analyze each segment, the overlaps create confusion.

Test for mutual exclusivity: Pick any specific item and ask: could this reasonably fit into two or more of my categories? If yes, you need clearer boundaries or different categories.

Collectively Exhaustive explained

"Collectively exhaustive" means no gaps. Your categories should cover all possibilities. Nothing should be left out.

Good example: Profit breakdown

Analyzing profit as Revenue minus Costs is collectively exhaustive. Every factor that affects profit either increases revenue, decreases revenue, increases costs, or decreases costs. There is no third category.

Bad example: Sales channels

Analyzing sales through "retail stores" and "e-commerce" might miss wholesale, B2B direct sales, or subscription models. Unless you are certain the company only has those two channels, this breakdown has gaps.

Test for collective exhaustiveness: Ask yourself: what scenarios or items would not fit into any of these categories? If you find something, you either need a new category or need to broaden an existing one.

MECE vs non-MECE examples

The following table shows common ways to segment or structure problems, comparing MECE and non-MECE approaches.

| Scenario | Non-MECE (Problems) | MECE (Better) |

|---|---|---|

| Customer age segments | Young, Middle-aged, Elderly (overlaps at boundaries) | 18-34, 35-54, 55+ (clear boundaries) |

| Revenue drivers | Marketing, Sales, Pricing (Marketing and Sales overlap) | Price x Volume (mathematically MECE) |

| Profit analysis | Sales, Marketing, Operations (misses other functions) | Revenue minus Costs (complete by definition) |

| Market entry options | Organic growth, Partnerships (misses acquisitions) | Build, Buy, Partner (covers all options) |

| Cost reduction | Labor, Materials, Overhead (overhead includes labor) | Fixed costs, Variable costs (no overlap) |

| Product issues | Quality, Design, Manufacturing (design affects quality) | Product vs Process issues (clear separation) |

Notice that MECE structures often use mathematical relationships (Price x Volume), clear numerical boundaries (age ranges), or established frameworks (Build/Buy/Partner). These are easier to keep MECE than fuzzy categories.

Common MECE mistakes

Overlapping categories disguised as distinct

"Internal factors" and "company capabilities" often cover the same ground. "Customer needs" and "market demand" overlap significantly. Watch for categories that sound different but actually capture similar things.

Listing what you know instead of what matters

Candidates sometimes create categories based on what comes to mind rather than what is logically complete. If you are analyzing a retailer and your buckets are "inventory," "store layout," and "promotions," you have listed three things you thought of, not a MECE structure of all relevant factors.

Using vague catch-all categories

Adding "Other" or "Miscellaneous" as a final category technically makes things collectively exhaustive but signals lazy thinking. If your "Other" bucket is large or important, break it down further. Interviewers notice when you use "Other" to hide weak structuring.

Mixing levels of abstraction

A framework with "Revenue," "Costs," and "Shipping efficiency" mixes high-level and specific items. Shipping efficiency is a subset of costs. Keep your categories at the same level, then break down each one separately.

Forcing MECE where it does not fit

Not everything needs to be MECE. Brainstorming creative ideas, listing risks, or generating hypotheses often should not be constrained by MECE. Save MECE for your main structure, not every list you create.

How to check if your structure is MECE

Before presenting a framework in a case interview, run through this quick checklist:

Step 1: Test for overlaps (Mutually Exclusive)

Pick a specific item or issue and check: could this fit into two of your categories? Try this with 2-3 different items. If anything could go in multiple places, either clarify your definitions or restructure.

Step 2: Test for gaps (Collectively Exhaustive)

Ask: what would not fit anywhere? Think of edge cases, unusual scenarios, or items the interviewer might mention. If you find something that falls outside all categories, you have a gap to address.

Step 3: Check the level consistency

Are all your categories at the same level of specificity? If one category is "Revenue" and another is "Marketing email open rates," they are at different levels. Keep your main buckets at the same altitude.

Step 4: Verify each category is meaningful

Each bucket should represent a significant area of analysis. If one category is "Revenue" and another is "Employee parking policy," they are not proportionate. Your categories should roughly equal in importance for the problem at hand.

With practice, this check takes only a few seconds. Build the habit now so it becomes automatic in interviews.

MECE in practice: Structuring a case

Here is how MECE works in a real case interview scenario.

Case prompt:

"Your client is a coffee shop chain that has seen profits decline by 15% over the past year. What would you look at?"

Non-MECE response (weak)

"I would look at: coffee quality, competition, pricing, customer satisfaction, and costs."

This list has overlaps (coffee quality affects customer satisfaction; pricing affects both revenue and customer decisions) and likely has gaps (what about location performance, new store openings, labor costs?). It is a list of things, not a structure.

MECE response (stronger)

"Since profit equals revenue minus costs, I would structure this as:"

1. Revenue: Has revenue declined? If so, is it due to lower prices, fewer customers, or lower spend per customer?

2. Costs: Have costs increased? If so, is it fixed costs (rent, labor) or variable costs (coffee beans, supplies)?

This structure is MECE at the top level. Every profit impact comes from either revenue or costs. There are no overlaps and no gaps. You can then drill into each area with additional MECE breakdowns.

Drilling deeper (still MECE)

If the interviewer says revenue has declined, you might break it down further:

Revenue = Price x Volume

- Price: Have we changed prices? How do we compare to competitors?

- Volume: Are we seeing fewer transactions? Lower items per transaction?

Or you might segment by location:

Revenue by store type:

- Existing stores (open more than 1 year)

- New stores (open less than 1 year)

Both are MECE. Price and Volume multiply to give Revenue with no overlap or gap. Existing and New stores cover all stores with clear boundaries. Practice structuring problems this way in structuring drills until it becomes natural.

FAQ

What does MECE stand for?

Mutually Exclusive, Collectively Exhaustive. Categories do not overlap and together cover all possibilities.

Why do consultants use MECE?

To avoid double-counting (analyzing the same thing twice) and blind spots (missing something important). MECE structures make complex problems manageable and communicate clearly.

Is MECE always necessary in case interviews?

Your main framework should be MECE. Sub-breakdowns can be more flexible. Brainstorming and idea generation often should not be constrained by MECE.

What is the easiest way to create MECE structures?

Use mathematical relationships (Revenue = Price x Volume), numerical boundaries (age 18-34, 35-54, 55+), or established frameworks (Build/Buy/Partner). These are naturally MECE.

How do I practice MECE thinking?

Take any business problem and practice structuring it in 2 minutes. Then check your structure for overlaps and gaps. Do this daily with structuring drills until MECE thinking becomes automatic.

What if my structure is not perfectly MECE?

Minor imperfections at lower levels are acceptable. What matters is that your main structure is solid. If an interviewer points out an overlap or gap, acknowledge it and adjust. Showing you can refine your thinking is a positive signal.

Practice MECE structuring

Build MECE thinking through targeted structuring drills and full case practice.

Start practicingLast updated: July 2025