M&A Cases: The Complete Framework

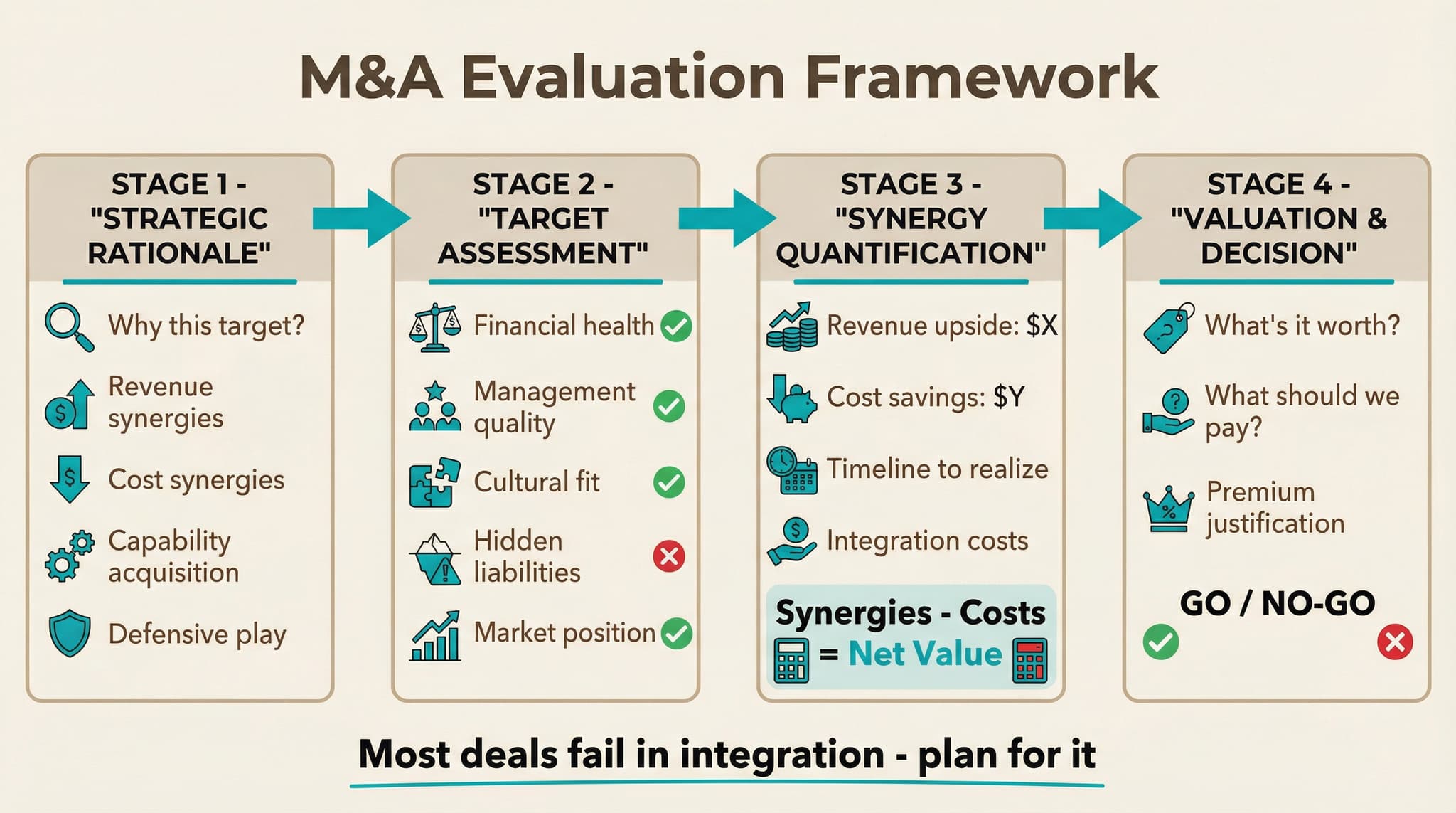

Summary: M&A (Mergers & Acquisitions) cases, also called deal cases, ask whether a company should acquire a target and at what price. Structure your analysis around four stages: Why acquire (strategic rationale)? Is the target worth acquiring (assessment)? What value can we create (synergies)? What should we pay (valuation)? Most deals fail in integration, so always address post-merger planning.

Contents

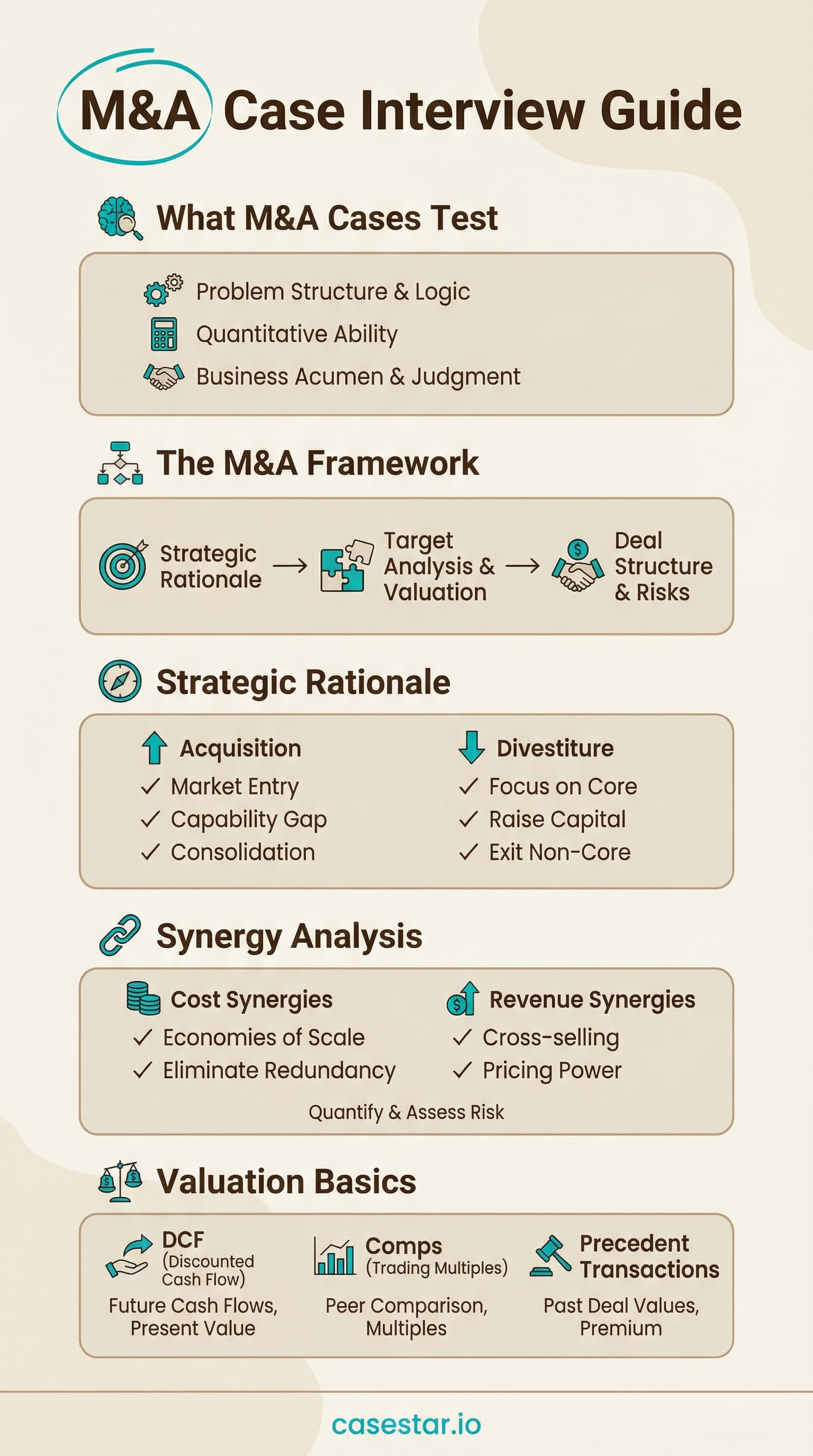

What M&A cases test

M&A cases are among the most challenging case types because they combine strategic thinking with financial analysis. A typical prompt sounds like: "Our client, a large consumer goods company, is considering acquiring a smaller organic food brand. Should they proceed, and if so, at what price?"

Unlike market entry cases where entry mode is one consideration among many, M&A cases focus specifically on the acquisition decision and require deeper financial analysis. You need to evaluate not just "should we do this" but "at what price does this make sense?"

Interviewers evaluate several skills in M&A cases:

- Strategic thinking: Can you articulate why an acquisition makes strategic sense?

- Financial acumen: Can you work with valuations, multiples, and synergy calculations?

- Risk identification: Can you spot integration challenges and deal-breakers?

- Negotiation awareness: Do you understand that price paid determines value captured?

The M&A framework (4 stages)

The M&A framework follows a logical progression: first establish why you want to acquire, then evaluate the specific target, quantify the value creation opportunity, and finally determine what price makes sense.

Stage 1: Strategic Rationale

Why acquire at all? Understand the strategic logic driving the deal. Is it about synergies, acquiring capabilities, entering new markets, or defensive positioning? The rationale shapes how you evaluate everything else.

Stage 2: Target Assessment

Is this specific target worth acquiring? Evaluate financials, management quality, cultural fit, and hidden liabilities. A great strategic rationale can still fail with the wrong target.

Stage 3: Synergy Quantification

What value can we create together? Calculate revenue synergies plus cost synergies minus integration costs. Be realistic - overestimating synergies is the most common reason deals destroy value.

Stage 4: Valuation

What should we pay? Stand-alone value plus synergies equals the maximum price. But paying 100% of synergies means you create no value for shareholders. Negotiate to capture some synergy value.

Strategic rationale: why acquire?

Before evaluating any specific target, clarify why the company is considering M&A in the first place. The strategic rationale determines what type of target to pursue and how to evaluate success.

Synergy-Driven

The combined entity is worth more than the sum of parts. Horizontal acquisitions (buying competitors) often focus on cost synergies from consolidation. Vertical acquisitions (buying suppliers or distributors) target margin capture and control. This is the most common rationale.

Capability Acquisition

Buying capabilities that would take too long to build organically. Technology companies often acquire for talent and IP. Traditional companies may acquire digital capabilities. Evaluate whether capabilities will transfer post-acquisition or walk out the door.

Market Access

Faster way to enter a new market than organic growth. Could be geographic (acquiring in a new country), customer segment (accessing enterprise vs SMB), or channel (acquiring e-commerce capability). Related to market entry but focused specifically on the buy option.

Defensive

Preventing competitors from gaining advantage. This could mean acquiring a target before a rival does, consolidating a fragmenting industry, or securing supply chain access. Defensive rationales are harder to justify financially but may be strategically necessary.

Tip: Ask clarifying questions about the strategic rationale before diving into analysis. Understanding "why" helps you focus on what matters most in the evaluation.

Target assessment and due diligence

Target assessment asks: "Is this the right company to acquire?" This is where due diligence happens - uncovering both opportunities and risks that affect deal value.

| Area | What to Evaluate | Red Flags |

|---|---|---|

| Financials | Revenue trends, margins, cash flow, debt levels, working capital | Declining revenue, shrinking margins, heavy debt, cash burn |

| Management | Leadership quality, depth of talent, retention plans | Key person dependency, planned departures, no retention agreements |

| Culture | Values, work style, decision-making, employee satisfaction | Major culture clash, low morale, recent leadership changes |

| Customers | Concentration, contract terms, satisfaction, churn rates | High concentration, change-of-control clauses, rising churn |

| Liabilities | Pending litigation, environmental issues, pension obligations | Material lawsuits, regulatory investigations, unfunded pensions |

Deal-Breakers vs Price Adjusters

Distinguish between issues that should kill the deal and issues that should adjust the price. Regulatory approval uncertainty might be a deal-breaker. A $10M pending lawsuit is a price adjuster. In interviews, identify which category risks fall into.

Synergy quantification

Synergies are the additional value created by combining two companies. The formula is straightforward:

Net Synergies = Revenue Synergies + Cost Synergies - Integration Costs

Revenue Synergies

- Cross-selling: Selling acquirer products to target customers (and vice versa)

- Pricing power: Raising prices due to reduced competition or stronger brand

- New markets: Accessing geographies or segments neither could reach alone

- Accelerated innovation: Combining R&D capabilities

Note: Revenue synergies are harder to achieve and take longer to materialize. Be conservative in estimates.

Cost Synergies

- Headcount reduction: Eliminating duplicate roles (finance, HR, IT, leadership)

- Facility consolidation: Closing redundant offices, plants, warehouses

- Procurement savings: Volume discounts from combined purchasing power

- Technology rationalization: Eliminating duplicate systems

Note: Cost synergies are more reliable but often require upfront investment (severance, facility closure costs).

Integration Costs

Synergies do not come for free. Factor in the costs to achieve them:

- Severance packages for laid-off employees

- IT system integration or replacement

- Facility closure and relocation costs

- Rebranding and marketing

- Management time and attention (opportunity cost)

- Customer attrition during transition

Common mistake: Overestimating synergies is the #1 reason M&A deals destroy value. Studies show realized synergies are typically 50-70% of initial projections. In case interviews, acknowledge this uncertainty and apply a haircut to aggressive estimates.

Valuation basics

Valuation determines what the target is worth and therefore what price makes sense. The key principle:

Maximum Price = Stand-Alone Value + Expected Synergies

Paying the maximum price means you capture zero value. Aim to pay less.

| Method | Description | When to Use |

|---|---|---|

| DCF | Discount projected free cash flows to present value. Intrinsic value based on fundamentals. | When you have reliable projections. Most theoretically sound. |

| Comparable Companies | Apply multiples (EV/EBITDA, P/E) from similar public companies. | When good comparables exist. Quick sanity check on valuation. |

| Precedent Transactions | Apply multiples from recent acquisitions in the same industry. | When negotiating - shows what buyers actually paid. Includes control premiums. |

Control Premiums

Acquirers typically pay 20-40% above the trading price for public companies to gain control. This premium is justified by the value the acquirer expects to create through synergies and operational improvements. In case interviews, remember that comparable company analysis gives you minority value - add a premium for control.

Negotiation Range

The seller wants maximum price (stand-alone value + all synergies). The buyer wants minimum price (stand-alone value only). The negotiation range is typically 50-75% of synergies paid to seller, meaning the buyer should capture 25-50% of synergy value. Your recommendation should include a price range, not just a single number.

Integration planning

Most M&A deals fail to create expected value, and integration is typically where they fail. Studies show 50-70% of deals underperform. Always address integration in your M&A case analysis.

Integration Models

Full integration: Combine operations completely. Maximizes synergies but highest risk. Best when acquiring for cost synergies.

Holding company: Keep operations separate, share only select functions. Preserves culture and capabilities. Best when acquiring for talent or brand.

Selective integration: Integrate back-office, keep front-end separate. Balances synergy capture with cultural preservation.

Key Integration Challenges

- Talent flight: Key employees leave due to uncertainty or culture clash

- Customer attrition: Customers defect during transition period

- Culture clash: Different values and work styles create friction

- Systems complexity: IT integration takes longer and costs more than expected

- Management distraction: Focus on integration diverts attention from core business

Interview tip: Even if the interviewer does not ask about integration, mention it in your recommendation. Acknowledging "the deal makes strategic sense at the right price, but success depends on careful integration planning" shows mature thinking about M&A risks.

Worked example approach

Prompt: "Our client is a large industrial equipment manufacturer. They are considering acquiring a smaller competitor that specializes in precision components. Should they proceed?"

Step 1: Clarify

Ask about our client: revenue size, current capabilities, geographic footprint? Ask about the target: revenue, profitability, key products, ownership structure? Ask about strategic context: why now, are there other bidders, what is the asking price?

Step 2: Structure

"I would like to evaluate this acquisition through four lenses: First, what is the strategic rationale - why does acquiring this target make sense? Second, is this target specifically worth acquiring - what do financials, management, and due diligence reveal? Third, what synergies can we expect - both revenue and cost? Finally, what is the right price to pay? I will also address integration considerations."

Step 3: Analyze each area

Strategic rationale: This is a horizontal acquisition for capability and market share. Target has precision manufacturing capabilities we lack and serves aerospace customers we want to reach.

Target assessment: Target has $200M revenue, 12% EBITDA margins (healthy), but high customer concentration (top 3 customers = 60% revenue). Management team is strong but founder is near retirement.

Synergies: Cost synergies of $15M annually (back-office consolidation, procurement). Revenue synergies of $10M (cross-selling to our distribution). Integration costs of $20M one-time.

Valuation: Comparable companies trade at 8x EBITDA. Target EBITDA is $24M, implying $192M stand-alone value. With $25M annual synergies (valued at 5x), max price is $317M. We should offer $250-280M to capture some synergy value.

Step 4: Recommendation

"I recommend pursuing this acquisition at a price between $250M and $280M. The strategic rationale is sound - we gain precision manufacturing capabilities and aerospace customer access. The target is fundamentally healthy though customer concentration is a risk we should address through retention agreements. Synergies of $25M annually are achievable but we should discount revenue synergies given execution uncertainty. At $265M, we would capture roughly 40% of synergy value. Key success factors are retaining the technical talent and key customer relationships through the transition."

FAQ

What is the M&A case framework?

The M&A framework evaluates deals through four stages: Strategic Rationale (why acquire), Target Assessment (is this target worth it), Synergy Quantification (what value can we create), and Valuation (what price makes sense). Integration planning should also be addressed.

What are synergies in M&A?

Synergies are additional value created by combining two companies. Revenue synergies include cross-selling and pricing power. Cost synergies include headcount reduction and facility consolidation. Net synergies equal revenue synergies plus cost synergies minus integration costs.

Why do most M&A deals fail?

Studies show 50-70% of deals fail to create expected value. Common reasons include overpaying (optimistic synergy assumptions), poor cultural integration, loss of key talent, customer defection, and underestimating integration complexity. Always address integration risks in your analysis.

How is M&A different from market entry?

Market entry cases evaluate whether to enter a new market and consider build, buy, or partner options. M&A cases focus specifically on the "buy" decision with deeper analysis of target evaluation, synergies, and valuation. Think of M&A as a specialized subset of market entry.

What valuation multiples should I use?

Common multiples include EV/EBITDA (most common for mature companies, typically 6-12x depending on industry), EV/Revenue (for high-growth companies), and P/E (for comparing to public markets). Use industry- specific comparables when available. The interviewer will usually provide relevant benchmarks.

Practice M&A cases

CaseStar offers interactive case practice with instant feedback on your strategic analysis and valuation reasoning.

Start practicingSave this guide

Last updated: January 2025