Market Entry Cases: How to Approach Them

Summary: Market entry cases ask whether a company should enter a new market and how. Structure your analysis around four questions: Is the market attractive? Can we compete? Do we have the capabilities? How should we enter? The answer is usually "it depends" - your job is to identify what it depends on and make a recommendation based on the specific situation.

Contents

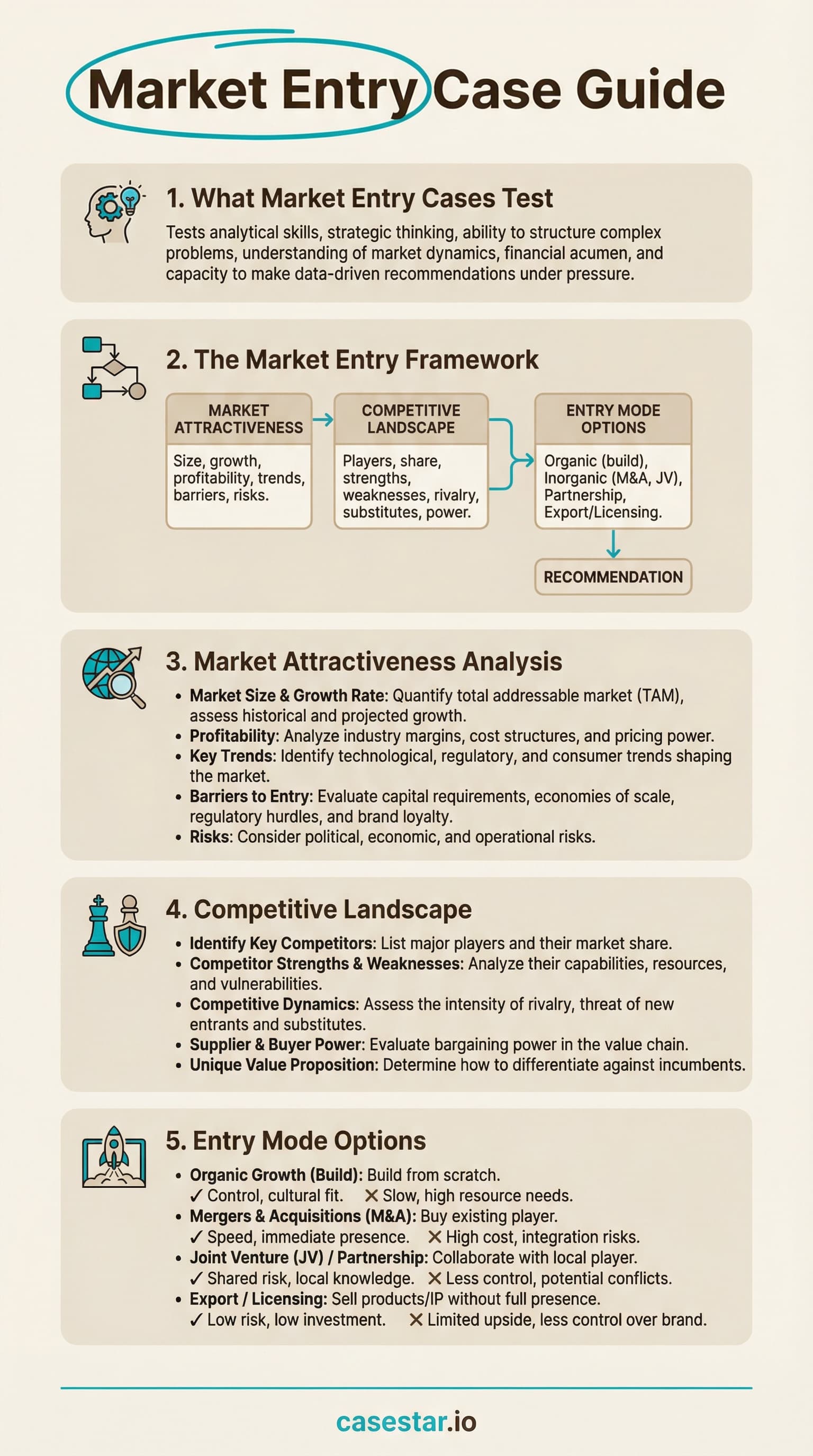

What market entry cases test

Market entry cases are among the most common case types, alongside profitability cases. They test whether you can evaluate a strategic opportunity systematically. The prompt usually sounds like: "Our client is a US consumer goods company considering entering the Indian market. Should they, and if so, how?"

Unlike profitability cases where the problem is clear (profits are down), market entry cases require you to define what success looks like. Is the goal market share? Revenue growth? Strategic positioning? Clarify objectives before diving into analysis.

Interviewers evaluate several skills in market entry cases:

- Strategic thinking: Can you evaluate opportunities at a market level?

- Data synthesis: Can you integrate market data, competitive info, and company capabilities?

- Risk assessment: Can you identify what could go wrong?

- Recommendation quality: Can you make a clear go/no-go call with supporting logic?

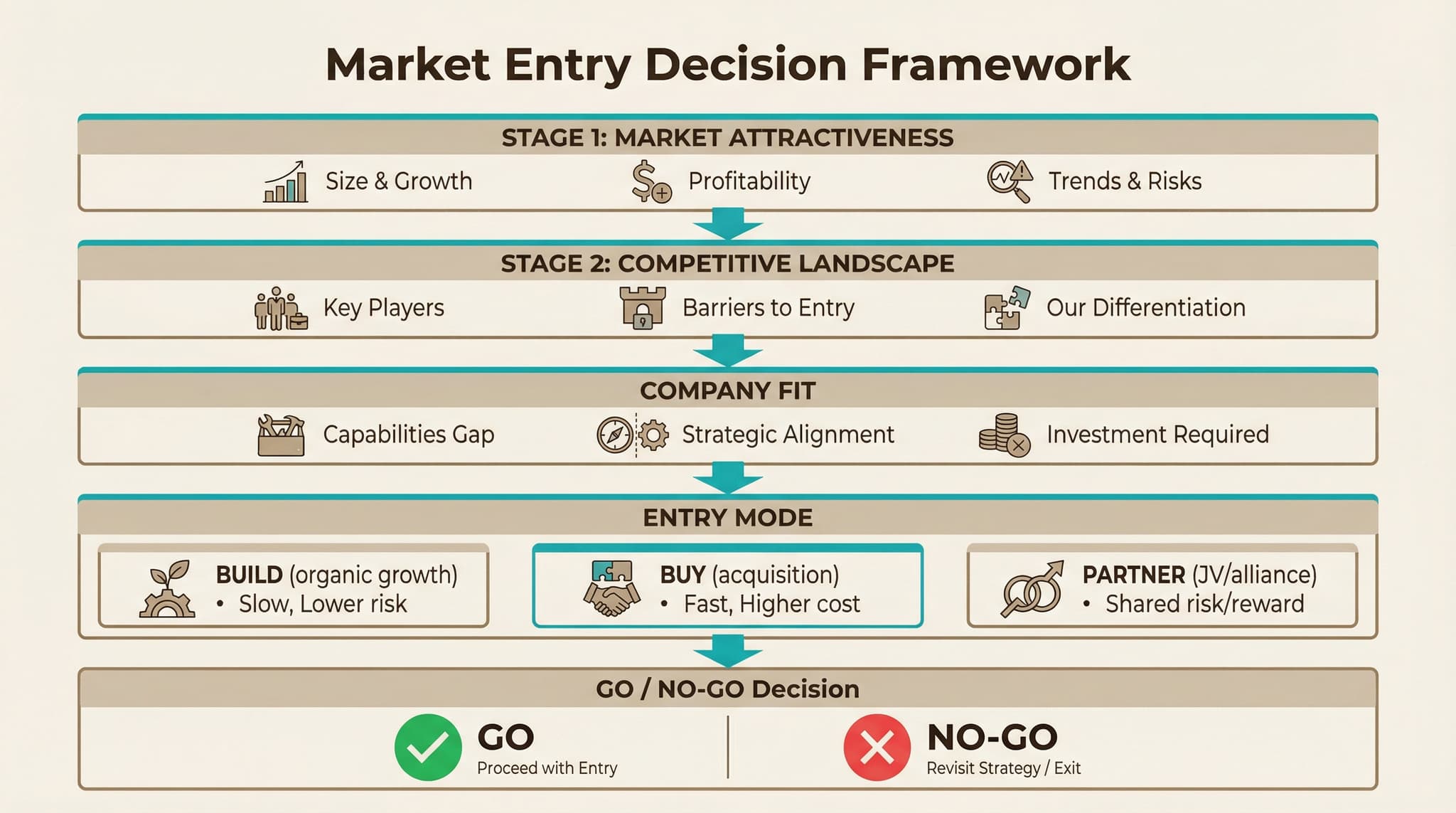

The market entry framework

The market entry framework follows a logical sequence: first determine if the market is worth entering, then assess if you can win, then decide how to enter. Each stage can be a go/no-go decision point.

Stage 1: Market Attractiveness

Is this market worth pursuing? Evaluate size, growth, profitability, and trends. A small, declining, low-margin market is rarely worth entering regardless of other factors.

Stage 2: Competitive Landscape

Can we compete effectively? Identify key players, barriers to entry, and sources of differentiation. A attractive market dominated by entrenched incumbents may not be winnable.

Stage 3: Company Fit

Do we have what it takes? Assess capability gaps, strategic alignment, and required investment. Even attractive markets with weak competition are poor choices if we lack relevant capabilities.

Stage 4: Entry Mode

If yes, how do we enter? Choose between building organically, acquiring an existing player, or partnering. Each has different speed, cost, and risk profiles.

Market attractiveness analysis

Market attractiveness answers the question: "Is this a market worth being in?" Think of it as the opportunity assessment before considering execution challenges.

| Factor | What to Assess | Key Questions |

|---|---|---|

| Market Size | Current revenue pool, addressable market | Is the market big enough to matter? |

| Growth Rate | Historical and projected CAGR | Is the market growing, flat, or declining? |

| Profitability | Industry margins, pricing power | Are participants making money? |

| Trends | Regulatory, technology, consumer shifts | Are trends favorable or threatening? |

| Risks | Volatility, customer concentration, disruption | What could derail the opportunity? |

Tip: For market sizing questions within market entry cases, use the top-down or bottom-up approach depending on available data. Cross-check your estimate with industry reports if the interviewer provides them.

Competitive landscape assessment

Even attractive markets can be poor entry targets if competition is fierce. This stage answers: "Can we win here?"

Key Players

Who are the major competitors? What are their market shares? Is the market fragmented (many small players) or concentrated (few large players)? Fragmented markets are often easier to enter.

Barriers to Entry

What makes it hard to enter? Common barriers include capital requirements, regulatory licenses, distribution access, brand loyalty, economies of scale, and switching costs. High barriers protect incumbents but also protect you once you are in.

Differentiation Potential

Can we offer something meaningfully different? If the market is commoditized and we cannot differentiate, entry likely leads to price wars. Look for underserved segments, unmet needs, or capability advantages.

Likely Competitive Response

How will incumbents react to our entry? Will they cut prices, increase marketing, or lock up distribution? Anticipate and plan for competitive retaliation.

Company fit and capabilities

A market can be attractive with manageable competition but still be wrong for a specific company. This stage asks: "Is this right for us?"

Capability Assessment

- Do we have relevant product or service expertise?

- Do we understand the target customers?

- Can we access necessary distribution channels?

- Do we have the operational capacity?

- What capabilities would we need to build or acquire?

Strategic Alignment

- Does this market fit our overall strategy?

- Are there synergies with existing businesses?

- Does it align with our long-term vision?

- Could it distract from core business?

- What is the opportunity cost?

Investment requirements are also critical. How much capital is needed? What is the expected timeline to profitability? What is the expected return, and does it meet investment hurdles?

Entry mode options: build, buy, or partner

If the decision is to enter, the next question is how. Three primary entry modes exist, each with different characteristics.

| Entry Mode | Description | Pros | Cons |

|---|---|---|---|

| Build (Organic) | Grow from scratch using internal resources | Full control, lower upfront cost, cultural alignment | Slow, uncertain, need to build everything |

| Buy (Acquisition) | Purchase an existing player in the market | Fast, immediate market presence, acquire capabilities | Expensive, integration risk, overpayment risk |

| Partner (JV/Alliance) | Joint venture or strategic alliance with local player | Shared risk, local expertise, moderate speed | Less control, profit sharing, partner conflicts |

Choosing the Right Mode

Build when: Speed is not critical, capital is limited, the market is nascent, or you have transferable capabilities.

Buy when: Speed matters, targets are available at reasonable prices, or you need capabilities you cannot build quickly. For more on acquisition analysis, see our M&A guide.

Partner when: Local knowledge is critical (especially international markets), regulatory requirements favor local players, or you want to test before committing fully.

Worked example approach

Prompt: "Our client is a mid-size US athletic apparel company. They are considering entering the Chinese market. Should they, and if so, how?"

Step 1: Clarify

Ask about the client: current revenue, product focus (performance vs lifestyle), existing international presence? Ask about goals: revenue target, timeline, risk tolerance? Ask about China specifically: any existing relationships or brand awareness there?

Step 2: Structure

"I would like to evaluate this through four lenses: First, is the Chinese athletic apparel market attractive in terms of size, growth, and profitability? Second, what does the competitive landscape look like - who are the key players and can we differentiate? Third, do we have the capabilities needed or can we build them? Finally, if the answer is yes, what entry mode makes sense?"

Step 3: Analyze each area

Market: Chinese athletic apparel is $50B growing at 12% CAGR - very attractive. Rising middle class, health consciousness, and sportswear-as-casualwear trend.

Competition: Nike and Adidas dominate (~40%), followed by local players Li-Ning and Anta. Mid-tier segment is fragmented with room for differentiated players.

Fit: Client has strong product design but no China experience. Would need local partnerships for distribution and marketing expertise.

Step 4: Recommendation

"I recommend entering the Chinese market, but through a partnership rather than organic entry or acquisition. The market is attractive and we can differentiate on design, but we lack local expertise. Partnering with a local distributor or retailer would give us market access while we build brand awareness. We could transition to a more direct model in 3-5 years once established. I would recommend starting with tier-1 cities and e-commerce channels like Tmall before expanding to physical retail."

FAQ

What is the market entry framework?

The market entry framework evaluates four areas: Market Attractiveness (size, growth, profitability), Competitive Landscape (players, barriers, differentiation), Company Fit (capabilities, alignment, investment), and Entry Mode (build, buy, or partner).

What are the three entry modes?

Build (organic growth), Buy (acquisition), and Partner (JV or alliance). Build is slowest but lowest risk. Buy is fastest but most expensive. Partner offers shared risk but less control.

How do I decide go vs no-go?

Go if: market is attractive, competition is manageable, you have or can build needed capabilities, and expected returns exceed investment hurdles. No-go if any of these conditions fails significantly. Sometimes the answer is "not now but revisit in X years."

How does market entry differ from growth strategy?

Market entry focuses on a specific new market opportunity. Growth strategy is broader - it considers all growth options including market entry, but also market penetration, product development, and diversification. Market entry is one quadrant of the Ansoff matrix.

Practice market entry cases

CaseStar offers interactive case practice with instant feedback on your market analysis and recommendations.

Start practicingSave this guide

Last updated: January 2025