Pricing Cases: How to Approach Them

Summary: Pricing cases ask you to determine the optimal price for a product or service. Structure your analysis around the Pricing Triangle: Cost (your floor), Competition (market reference), and Value (your ceiling). The optimal price captures customer value while remaining competitive and covering costs. Your job is to analyze all three factors and recommend a price with supporting logic.

Contents

What pricing cases test

Pricing cases are closely related to profitability cases since price directly impacts revenue and margins. The prompt typically sounds like: "Our client is launching a new electric vehicle. How should they price it?" or "A competitor just cut prices by 20%. How should we respond?"

Unlike market entry cases where you evaluate whether to enter, pricing cases assume you are already competing and need to optimize your position. The challenge is balancing multiple objectives: maximizing revenue, maintaining market share, and achieving target margins.

Interviewers evaluate several skills in pricing cases:

- Analytical thinking: Can you break down cost structures and calculate breakeven points?

- Market awareness: Can you incorporate competitive dynamics and customer behavior?

- Value quantification: Can you estimate willingness to pay based on product benefits?

- Strategic judgment: Can you recommend a price that balances short-term revenue with long-term positioning?

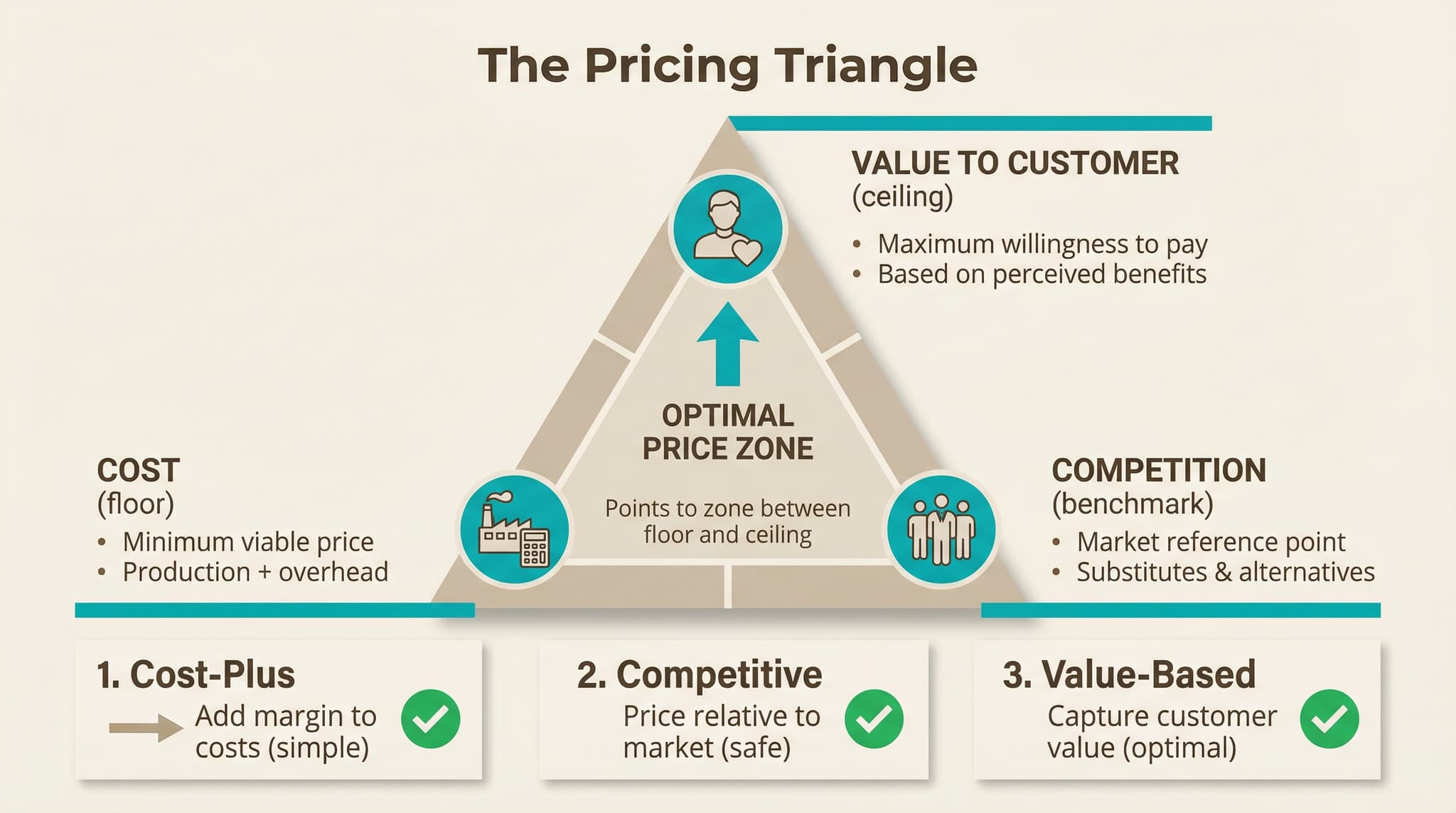

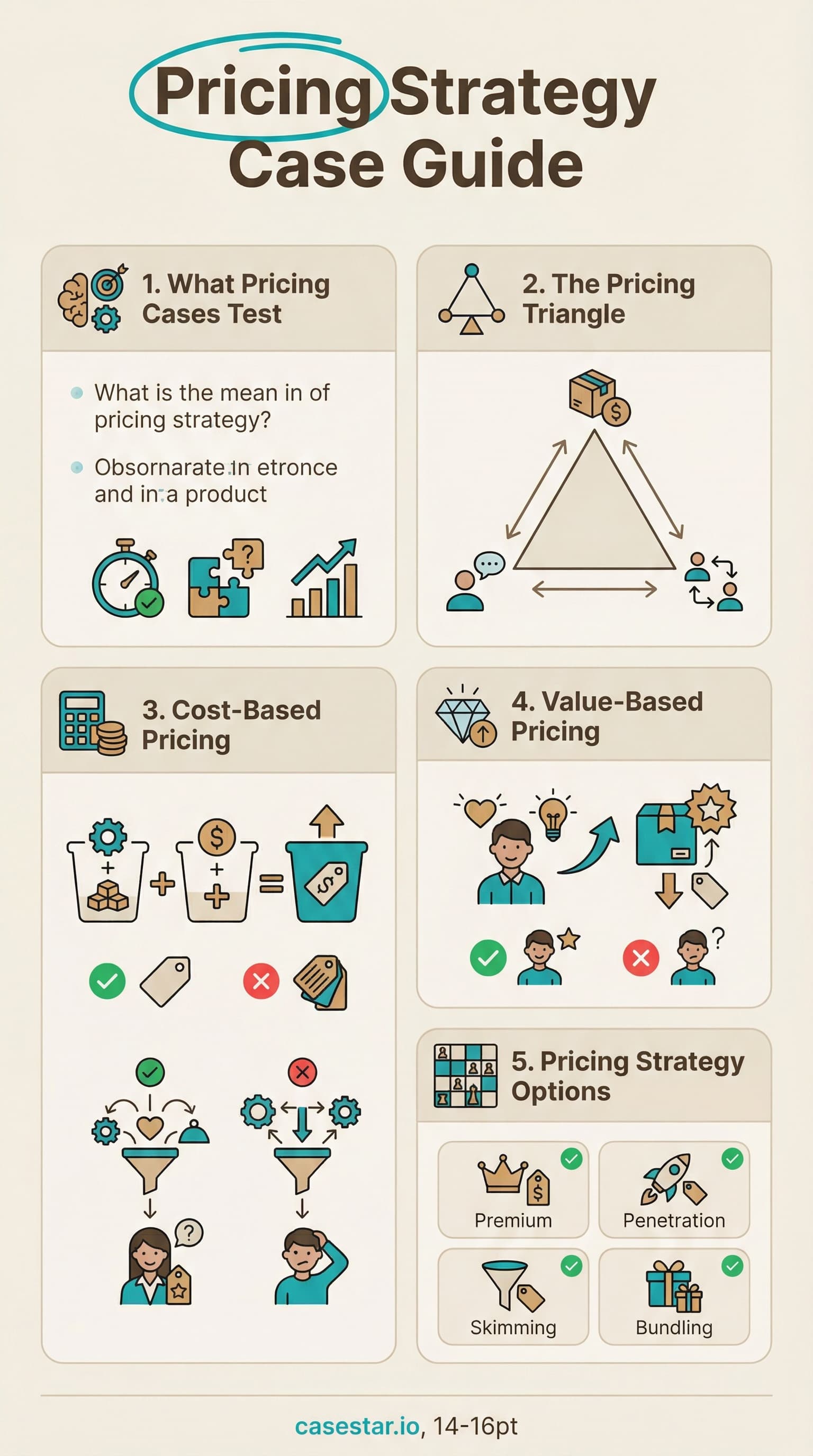

The Pricing Triangle framework

The Pricing Triangle is the foundational framework for pricing cases. It establishes three reference points that define your pricing range: Cost sets the floor, Value sets the ceiling, and Competition provides market context.

Cost (Floor)

Your minimum viable price that covers all costs. Pricing below this point means losing money on every sale. Include variable costs (materials, labor, shipping) and allocate fixed costs appropriately. This is your absolute floor - never go below unless you have a strategic reason like market penetration.

Competition (Reference)

Market prices from direct and indirect competitors. This is what customers use as a reference point when evaluating your price. You can price above or below competitors, but you need to justify the gap with differentiation (premium) or efficiency (discount).

Value (Ceiling)

The maximum price customers are willing to pay based on perceived value. This reflects the economic benefit your product delivers compared to alternatives. Pricing above the value ceiling means customers will choose competitors or substitutes. This is your theoretical maximum.

Key insight: The optimal price sits between your cost floor and value ceiling, informed by competitive positioning. A large gap between cost and value indicates strong pricing power. A narrow gap indicates a commoditized market where pricing flexibility is limited.

Cost-based pricing

Cost-based pricing starts with your costs and adds a target margin. It is the simplest approach and ensures profitability, but ignores what customers are willing to pay.

Cost-Plus Pricing

Calculate total cost per unit, then add a fixed percentage markup. For example: $100 cost + 30% markup = $130 price. Common in manufacturing, construction, and government contracts where cost transparency is required.

Target Return Pricing

Set price to achieve a specific return on investment. Work backward from required profit, allocate across expected volume, and add to unit cost. Useful when capital investments are significant and ROI hurdles are clear.

| Pros | Cons |

|---|---|

| Simple to calculate and explain | Ignores customer willingness to pay |

| Guarantees margin on every sale | Ignores competitive positioning |

| Easy to adjust with cost changes | May leave money on the table or price out of market |

When to use cost-based pricing: Commoditized products with little differentiation, contract work with cost-plus agreements, or as a starting point to establish your floor before considering competition and value.

Competitive pricing

Competitive pricing uses market prices as the primary reference point. It is safe because you know the market will bear the price, but it can lead to commoditization and price wars.

Market-Based Pricing

Set price at or near the market average. Appropriate when products are similar and customers are price-sensitive. The focus shifts to winning on non-price factors like service, convenience, or brand.

Competitive Benchmarking

Map competitors on price vs. features/quality. Position yourself deliberately: match leaders, undercut to gain share, or price above with clear differentiation. Always know why your price differs from competitors.

Price Leadership/Following

In some markets, one player sets the price and others follow. Airlines and gas stations often exhibit this pattern. Understand who the price leader is and how they set prices.

Price Above Market

- Requires clear differentiation

- Strong brand or quality perception

- Unique features or benefits

- Risk: losing price-sensitive customers

Price Below Market

- Requires cost advantage

- Gaining market share

- Disrupting incumbents

- Risk: price war, margin erosion

Value-based pricing

Value-based pricing sets price according to the value customers perceive and are willing to pay. It captures the most value when executed well but requires deep customer understanding.

Economic Value to Customer (EVC)

Calculate the economic benefit your product delivers compared to the next best alternative. EVC = Reference Price + Differentiation Value. If your software saves customers $50,000/year in labor costs compared to manual processes, that quantifies your value ceiling.

Willingness to Pay (WTP)

The maximum price a customer would pay rather than go without. WTP varies by customer segment - business customers may have higher WTP than consumers. Estimate through surveys, conjoint analysis, or A/B testing.

Value Drivers

Identify what creates value for customers: cost savings, revenue increase, risk reduction, convenience, status, emotional benefits. Different segments value different things. Price according to the value most important to your target segment.

| Value Type | Example | How to Quantify |

|---|---|---|

| Cost Savings | Automation software replacing manual labor | Hours saved x hourly cost |

| Revenue Increase | Marketing tool increasing conversions | Incremental revenue generated |

| Risk Reduction | Insurance or security product | Expected loss x probability avoided |

| Time Savings | Express shipping or faster service | Value of time to customer |

Best practice: Capture a portion of the value you create, not all of it. If you price at 100% of EVC, customers have no incentive to switch. Aim for 30-70% of the value you create, leaving enough surplus for customers to see clear benefit.

Pricing strategy options

Beyond the pricing approach, you need a pricing strategy that aligns with business objectives. Different strategies suit different market positions and goals.

Penetration Pricing

Set low prices initially to gain market share quickly. Works when there are network effects, high customer lifetime value, or economies of scale that lower costs as volume grows. Risk: may attract price-sensitive customers who leave when prices rise.

Example: Streaming services offering low intro rates, ride-sharing subsidies in new markets.

Price Skimming

Start with high prices and lower over time. Captures maximum value from early adopters willing to pay premium, then expands market as price drops. Works for innovative products with limited competition.

Example: New technology products (smartphones, gaming consoles), fashion items.

Premium Pricing

Maintain consistently high prices to signal quality and exclusivity. Requires strong brand, genuine differentiation, or luxury positioning. Volume will be lower but margins are higher.

Example: Luxury brands (Hermes, Rolex), premium professional services.

Economy Pricing

Consistently low prices with minimal margins, relying on high volume. Requires operational efficiency and cost leadership. Attracts price-sensitive segments.

Example: Discount retailers (Aldi, Costco), budget airlines.

| Strategy | Best For | Risk |

|---|---|---|

| Penetration | New markets, network effects, scale economics | Attracting wrong customers, unsustainable losses |

| Skimming | Innovative products, limited competition | Inviting competition, slow market growth |

| Premium | Strong brand, genuine quality advantage | Limited market size, brand dilution if discounting |

| Economy | Cost leadership, price-sensitive markets | Margin pressure, race to bottom |

Price elasticity concepts

Price elasticity measures how demand changes when price changes. It is critical for predicting the revenue impact of pricing decisions.

The Elasticity Formula

If a 10% price increase leads to a 15% decrease in demand, elasticity is -1.5 (elastic). The negative sign is often dropped since price and demand move in opposite directions.

Elastic Demand (|E| > 1)

- Demand is price-sensitive

- Many substitutes available

- Non-essential purchases

- Price cuts may increase revenue

- Example: airline tickets, restaurants

Inelastic Demand (|E| < 1)

- Demand is price-insensitive

- Few substitutes available

- Essential or addictive products

- Price increases may increase revenue

- Example: insulin, gasoline, cigarettes

Factors Affecting Elasticity

- Availability of substitutes: More substitutes = more elastic

- Necessity vs luxury: Necessities are more inelastic

- Share of budget: Bigger purchases are more elastic

- Time horizon: Demand is more elastic over longer periods as customers can adjust

- Brand loyalty: Strong brands have more inelastic demand

Revenue optimization: At unit elasticity (|E| = 1), revenue is maximized. If demand is elastic, consider lowering prices. If demand is inelastic, you may have room to raise prices. Always estimate elasticity before making pricing recommendations.

Common pricing scenarios

Pricing cases typically fall into three categories. Each requires a different approach and set of considerations.

Scenario 1: New Product Pricing

"How should we price our new product launch?"

Approach: Start with value-based pricing. Identify comparable products and quantify your differentiation. Consider launch strategy (penetration vs skimming). Factor in long-term positioning - initial price sets expectations.

Key questions: What alternatives exist? How much better is our product? What are customer segments and their WTP? What is our market share goal?

Scenario 2: Responding to Price War

"A competitor just cut prices by 20%. How should we respond?"

Approach: Do not assume you must match. First, understand why they cut prices - desperation, new cost structure, or strategic choice? Assess your cost position and ability to sustain lower prices. Consider non-price responses like adding value, targeting different segments, or selective discounting.

Key questions: Why did they cut prices? Can we match profitably? How price-sensitive are our customers? Can we differentiate instead?

Scenario 3: Optimize Existing Pricing

"We want to improve profitability through pricing. What should we change?"

Approach: Analyze current pricing structure. Look for opportunities: raise prices on inelastic products, adjust segment pricing, optimize product/service bundles, reduce discounting leakage, implement dynamic pricing.

Key questions: Where are we leaving money on the table? Which customers are over/under-paying? How much discounting leakage exists? Can we tier pricing by segment?

Worked example approach

Prompt: "Our client is a B2B software company launching a new productivity tool. How should they price it?"

Step 1: Clarify

Ask about the product: What does it do? What problem does it solve? Who is the target customer (SMB vs enterprise)? Ask about the market: Who are the competitors and what do they charge? Is this a new category or established market? Ask about objectives: Is the goal market share, profitability, or market positioning?

Step 2: Structure

"I would like to approach this using the Pricing Triangle framework. First, I will establish the cost floor by understanding our costs. Second, I will look at competitive pricing to understand market reference points. Third, I will estimate value to customers to find our ceiling. Then I will recommend a price and pricing strategy based on these three factors."

Step 3: Analyze each pillar

Cost: Hosting and infrastructure costs $5/user/month. Development is sunk cost. Support costs $2/user/month. Total variable cost: $7/user/month. This is our floor - we cannot go below $7 without losing money.

Competition: Similar tools (Asana, Monday.com) charge $10-25/user/month for business tiers. Premium features command $25-50/user/month. Market expects $15-20 for mid-tier solution.

Value: Our tool saves users ~5 hours/month. At $50/hour fully-loaded cost, that is $250/month in productivity savings. Even capturing 10% of that value suggests $25/user/month ceiling.

Step 4: Recommendation

"I recommend pricing at $19/user/month for the standard tier. This is above our $7 cost floor, competitive with alternatives at $15-25, and well below our $25 value ceiling - giving customers clear ROI. I would suggest a penetration strategy with annual discounts (15% off for annual commitment) to build market share. We should also offer a free tier for small teams to drive adoption and upsells. For enterprise customers with more complex needs, we can offer a premium tier at $35/user/month with additional features."

FAQ

What is the Pricing Triangle framework?

The Pricing Triangle evaluates three factors: Cost (your floor that covers expenses), Competition (market reference prices), and Value (your ceiling based on customer willingness to pay). The optimal price sits between floor and ceiling, informed by competitive position.

What are the three main pricing approaches?

Cost-based (add margin to costs), Competitive (price relative to market), and Value-based (capture customer willingness to pay). Cost-based is simplest but ignores value. Competitive is safe but commoditizing. Value-based captures most value but is hardest.

What is price elasticity and why does it matter?

Price elasticity measures how demand changes with price. Elastic demand (|E| > 1) means price-sensitive customers - lower prices may increase revenue. Inelastic demand (|E| < 1) means customers are less price-sensitive - you may have room to raise prices.

How does pricing relate to profitability cases?

Pricing directly impacts the revenue side of the profitability equation (Revenue = Price x Volume). In profitability cases, pricing optimization is often a key lever for improving margins. Many profitability cases include a pricing component.

When should I use penetration vs skimming pricing?

Use penetration pricing when: there are network effects, high customer lifetime value, or economies of scale to capture. Use skimming when: you have innovative products, limited competition, and early adopters willing to pay premium prices.

Practice pricing cases

CaseStar offers interactive case practice with instant feedback on your pricing analysis and recommendations.

Start practicingSave this guide

Last updated: January 2025